Published October 1, 2022

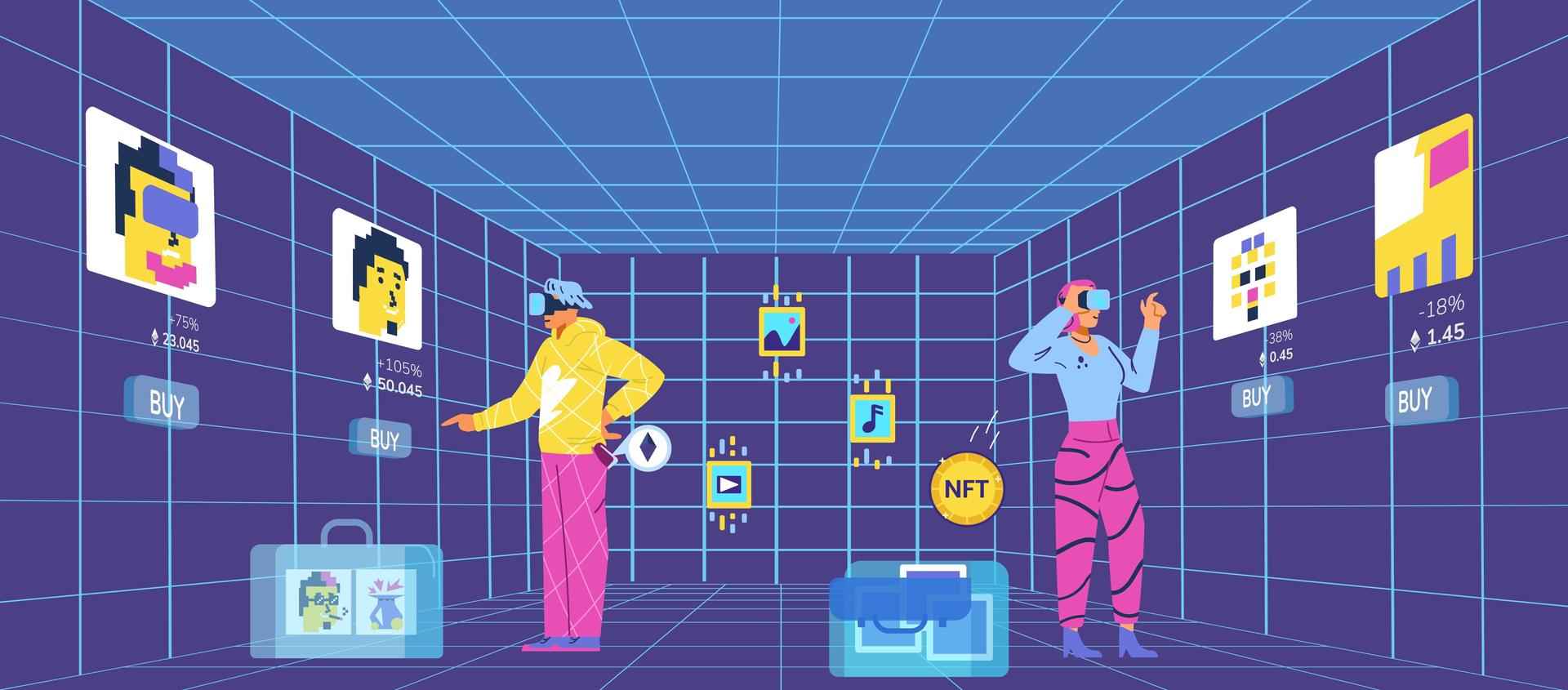

The rise of the blockchain and digital assets led to a frenzy of NFT creation in 2021. However, by the end of that year, these markets began to cool off slightly. In the first three quarters of 2022, trading volumes are down significantly with some estimates in the range of 97%. That might not seem like a good sign for the future of NFTs. After all, if less money is being invested in these projects right now, that may lead to interest fading from the overall ecosystem. That’s why this article dives into what caused this crash and what it means for you going forward.

What caused the NFT market to crash?

According to Chainalysis economist Ethan McMahon, the sharp fall in NFT transaction volumes cannot be solely attributed to plummeting cryptocurrency prices. In addition, the inflated market was, to an extent, responsible for the sharp decrease in transaction values. The hype around what can be considered profile picture NFT collections has been quite strong over the past 18 months,” says McMahon. These are collections such as the Bored Ape Yacht Club and Beeple’s crypto art, which was purchased for $60 million for a single piece at the height of the NFT hype in 2021.

Will NFT markets ever recover?

Some NFT industry professionals believe that the NFT market will continue to grow and play an increasingly important role in the digital economy. This is due to continued use in the video game, music, art, and digital collectible industries along with additional use cases bridging the digital and real worlds. However, the symbiotic relationship between NFTs and cryptocurrency markets is inescapable. Thus, will NFTs always be subject to the volatility of the cryptocurrency market? As the crypto artwork sector matures, it may follow the physical art sector, which is not necessarily linked to the fluctuations of the cryptocurrency market.

Evaluate unknown assets or new platforms carefully

One of the first things you need to do when you are researching NFT projects is to decide which ones you are going to rule out. Not every project is worth investing in, and not every NFT asset is worth purchasing. You don’t want to put your money into a project that has no clear path to success. You also don’t want to purchase an NFT that has little to no value on the market because it’s not being used by anyone. In order to make sure you stay out of these types of assets, do your research. You can start by reading articles and blog posts about the state of the market, but most importantly check out the discord and or telegram presence of these projects.

Look for focused businesses and established games

When you’re looking at different NFT projects, you want to make sure that the business behind the token makes sense. If a token is being used as a key to unlock certain in-game content or items, you want to make sure that that part of the game is actually being developed and scheduled to be released. You also want to make sure that the business is focused on that one token. If the company has a bunch of different tokens that are being traded on the market, it could be a red flag. Those companies might just be trying to get as many tokens out there as possible in order to appear successful.

Final Words: Why NFTs will still matter

NFTs are the perfect tool to foster community and give access to perks online and in real life. As NFTs and metaverses develop, the complexity of their utilization will likewise grow, and metaverses will require interoperability as much as they do in real life. Blockchain and NFTs will make the digital realm more transparent as their capacity to verify digital ownership will be an economic incentive to adopt them. The market is maturing: We anticipate a future where many things will become NFTs. So our recommendation to you is to continue to find ways to be a part of this exciting ecosystem as it in turn evolves to become a part of everything we do.